Savings Plan, you are among a minority of wise military members who have taken advantage of a great program. You're work isn't over yet though. The allocation of where that money is invested can make all the difference.

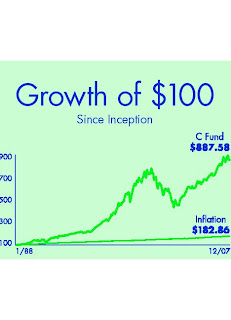

Savings Plan, you are among a minority of wise military members who have taken advantage of a great program. You're work isn't over yet though. The allocation of where that money is invested can make all the difference.If you don't select an option, the TSP administrators will deposit your entire investment into the G Fund, or the Government Insured Securities Fund. As the chart on the left shows, this fund has earned about 6% since April 1987. A $100 investment then would have been worth $364 in December 2007.

If you had instead selected the TSP C-Fund, a fund that mirrors the S&P 500 stock index, this fund would have returned more than 11% per year, on average.

That same $100 would be worth more than $880!

That same $100 would be worth more than $880!The lesson here is that your TSP investment doesn't end when you sign up, it just begins! Keep an eye on TSP.gov and review the investment options. Select a combination of the funds to suit your needs and investment risk tolerance, or pick a life cycle fund and let the administrators build you a portfolio. The difference in returns is very significant, and since this money is for long term growth, it pays to do your homework.

1 comment:

Great post Lee.

Don't forget that the S and I funds correspond to good low cost index funds as well. My money is in the S fund which more or less gives you access to the total stock market as it tracks a combo platter index of the Wilshire 4500 and the S&P 500.

I've used the I fund in the past, but now have my international money in one of my other IRA accounts. Regardless, the I fund tracks the Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index.

The C, S, I funds, or some combination of them can make a great, solid, low cost portfolio.

Keep up the great work.

Jeff

I'm Minding My Own Business, are you minding yours?

Post a Comment